We're here for you

We're here for you

Whether you need make a claim or to ask a question we're only a phone call away.

For claims

Call13 24 8024 hours, 7 days a week

For general enquiries

Call13 24 81Personal Insurance

8:30am to 5:00pm AEDST, Monday to Friday

Business Insurance

8:00am to 8:00pm AEDST, Monday to Friday

While overseas

Call +61 3 9601 8222CGU InSTRIVE

Keep up to date with broker insights for the quarter

July 2020

Check out news and views in this quarter's CGU InSTRIVE

1. A message from Brad Robson

Hi all,

Welcome to the July issue of CGU EDGE.

If you had told me last year that we would be closing FY20 in a market that is in partial lock-down, I wouldn’t have been able to imagine it, let alone believe it. We’ve certainly clocked up the hours on video calls, however I know that some of you are back in the office now, so our team is working on a plan so we can see you face to face again very soon.

We’d like to thank you for the support we’ve received during these challenging times and look forward to continuing our engagement with you as we face FY21 together.

In this edition of CGU EDGE, I recap some of the initiatives we’ve rolled out and those still to come under CGU’s COVID-19 Broker Support measures. These initiatives were designed to help you stay on top of your game and continue to support your customers whilst trading under the ‘new normal’. We’ve received great feedback from you on these initiatives and if you want to know more, please see COVID-19 Support Measures for a full overview and continue to share your thoughts.

We feature Motor Fleet in this edition and share with you what sets us apart from our competitors. We also talk about what we are offering to support the favourable Crop season under our Agribusiness update.

Finally, I introduce you the Fast 5 – my team of State Managers for Broker Solutions, who have worked incredibly hard over the last few months to maintain a sense of normality for our staff and brokers.

Enjoy and keep well.

Brad Robson

2. COVID-19 Support Measures

Our commitment to providing a range of measures and initiatives to help our Broker Partners at this time has been a priority. Our aim was to provide you with meaningful initiatives that help ease some of the pressures that have been created by the rapid change in our industry. These are all still available to you now.

Free and confidential counselling support for all Broker Partners

We partnered with Assure to offer you and your immediate family members access to a free confidential coaching and counselling service that's available 24/7. You can get counselling and psychological support, wellbeing coaching, financial coaching, legal and nutritional advice. Just call 1800 001 018 and say you're a CGU Broker Partner.

Lifeline Accidental Counsellor training workshops

We also partnered with Lifeline to provide our key partners the opportunity to participate in an ‘Accidental Counsellor’ workshop that coaches you for skills that can help when dealing with distressed customers. If you're interested in attending, please contact your Account Partner.

CGU ‘Business as Unusual’ live event series

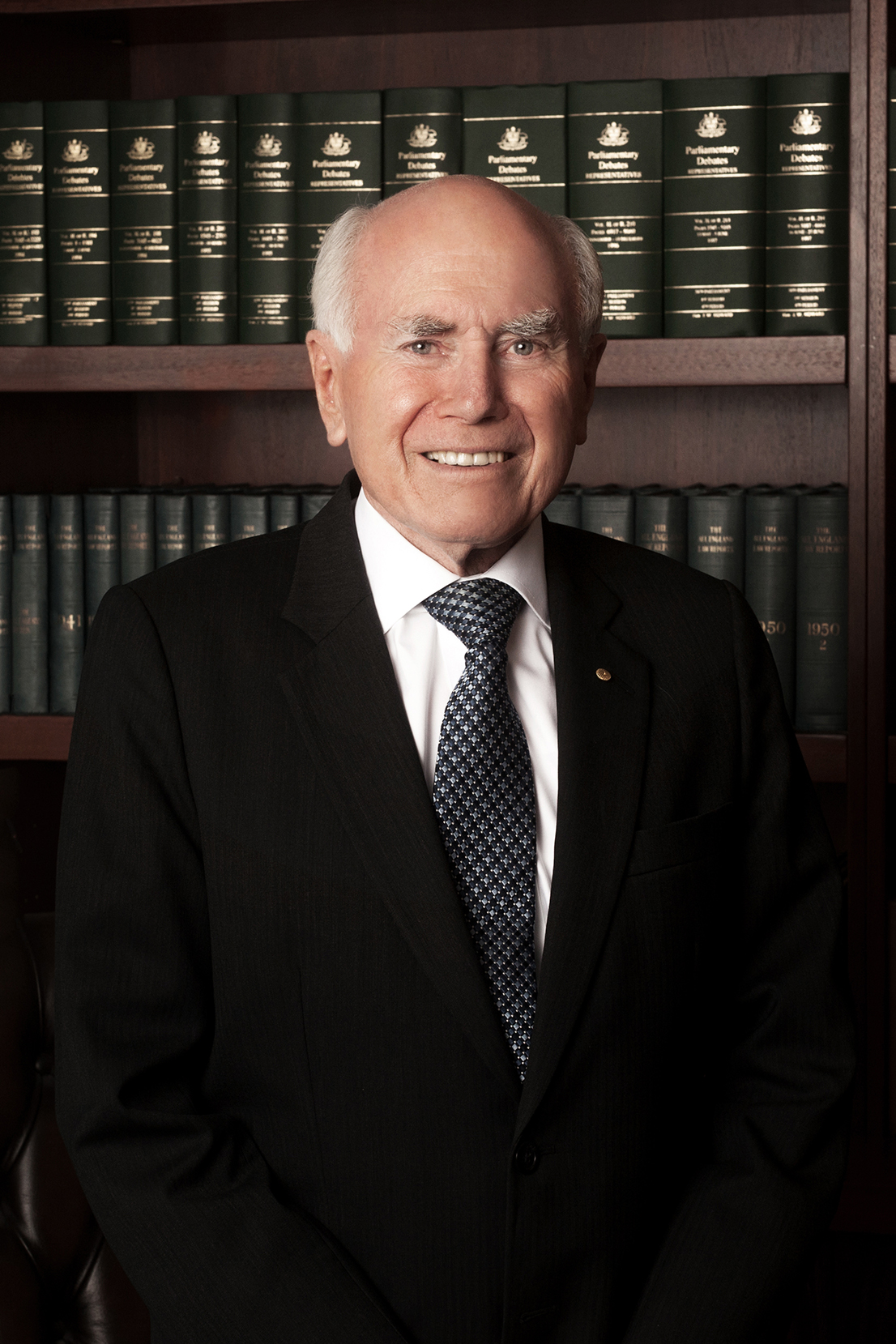

Our ‘Business as Unusual’ live event series gives partners the opportunity to hear from high-profile Australian figures and businesspeople including former Australian Prime Minister, John Howard, well-known Australian businessman, Mark Bouris AM, and futurist and media commentator, Chris Riddell.

Watch the recording of Mark Bouris

Watch the recording of Chris Riddell (only available till 10 July)

NIBA webinar series

Partnering with NIBA, we're also providing CPD accredited learning and development opportunities for insurance brokers Australia-wide. These sessions can be viewed at your convenience via the NIBA learning platform.

A digital marketing boost for Broker Partners

Over the next few months we'll be offering key Broker Partners a fully funded digital marketing campaign with an independent digital marketing agency, OneAffiniti.

Click here to see how this can help give your business an extra boost

A number of customer support measures have also been released which you can find on our FAQ page. We thank everyone who gave us feedback on these measures:

“Like many of our industry counterparts, we have a number of clients facing financial challenges resulting from COVID-19. Recently, a long-standing client of CGU approached us to seek hardship assistance with cashflow support. Their sector has been particularly hard-hit but due to their size, they would not normally qualify for hardship measures that are geared for SME’s. To ours and the clients’ delight, CGU were able to provide support seeing how their business has been severely impacted.”

John Walsh, Client Service Director NSW at Austbrokers Corporate

“The payment deferrals has taken a lot of pressure off our clients during the shutdown. One of the biggest benefits is that it helped them keep their staff as they have the funds to pay wages and then get the Job-keeper payments. Knowing their property is covered whilst they are working from home or, not being able to work at all, has given the clients another level of support and confidence. Not having to go to big costs or jump through hoops to ensure cover is in place for unoccupied business premises has been really important.”

Andrew Benda, Managing Director at City Rural Insurance Brokers Pty Ltd

3. Product in focus – Motor Fleet

Partnering with CGU Motor Fleet provides you with an edge because of our market leading Total Motor Solutions approach. We tailor our offering based on the 3 key elements your clients need – experienced underwriting, claims excellence and risk management.

Experienced underwriting

CGU Motor Fleet has broad risk appetite, with superior coverage with tailored wordings that provides flexible risk transfer solutions. Our risk transfer options include the ability to consider:

- Comprehensive cover as a conventional or burning cost

- Ability to handle uninsured below excess losses

- Aggregate deductible programs with or without an underlying excess

- Claims handling only

- Excess caps at an event and/or annual basis

- Sharing of profits through Claim Experience Discounts (CED).

Each Motor Fleet have different needs – with our experienced Motor Fleet Underwriters located in every state, we offer you the ability to work closely with us to find your client the right solution.

Claims excellence

The cornerstone of all Motor Fleet programs is the ability to provide detailed reporting of losses. Reporting available include:

- Standard claims experience report

- Analysis by cause of loss, vehicle by loss period, by liability, by loss location, by drive

- Five year dashboards

- Client extracts.

Our Motor Fleet Claims Team have the expertise and knowledge to handle your motor vehicle claims. We have highly skilled claims consultants to support your business when it counts the most and you will have access to our Claims Management Team.

We understand that claims handling methodology and performance has a significant impact on your business. We therefore use a flexible claims management model which allows us to streamline decision making processes and remove many of the potential hurdles that are inherent in other standard claims models.

We also have an easy to use Claims Portal at our partner's disposal that allows for:

- Immediate online lodgement and claim number provided

- Updates in real-time and when it's most convenient for you

- Repairer locator tool that identifies nearby partner repairers

- Available to both Brokers and Fleet clients 24/7.

Risk management

Our Risk Partners Team will engage with all clients national over $50k GWP to understand a clients' needs and requirements in the following critical areas:

- Commitment to safety

- Driver induction

- Driver training

- Driver administration

- Driver monitoring

- Vehicle management

- Incident management.

The aim is to provide feedback, recommendations and action plans that are linked to solutions. The solution connection is the starting point – we will partner with our brokers and clients to help drive a safety-first culture, whilst improving the performance of the fleet.

With COVID-19 changing all aspects of society, Motor Fleet's are not immune. In conjunction with the IAG Research Centre, we've developed this video to assist you and our Motor Fleet clients to stay safe using motor fleets.

4. Crop season is in full swing

The Winter Crop season is looking to be a strong one, so now is the time to help your clients to protect their valued produce. But did you know that not all Crop Insurance coverages are the same? To help you, please see this brochure which highlights the features, benefits and options that make the CGU Winter Crop Insurance offering one of the best in the market. Our product includes options like agreed value, reducing excess and after harvest adjustment.

You can also use our online user-friendly platform, Crop Insure, to get a quote and bind cover immediately. Crop Insure is a user-friendly platform that’s available via our CGU Portal. If you don’t have access to Crop Insure simply contact your CGU Account Partner.

Good news for hobby farms

The CGU Countrypak Hobby Farm acceptance criteria has been changed to include properties up to the following:

- Land size up to 40 hectares or 100 acres (previously 20 hectares or 50 acres)

- Turnover up to $50,000 or less (previously $20,000 or less).

Some farmers are still in drought

You may be surprised to know that despite the rain we’ve had, a number of areas in New South Wales and Queensland continue to be impacted by the on-going drought. It’s for this reason that the IAG Drought Assistance Program remains in place and allows an eligible CGU Countrypak customer experiencing financial hardship to defer some or all of their premium payments for 12 months. This will help ensure that they have a policy to claim under should the need arise, avoiding being underinsured or not insured at all.

IAG and Elantis Premium Funding are partnering together on this initiative, and we will continue to work with individual customers to tailor an appropriate repayment plan. This is available to all primary producer farming customers with a CGU Countrypak policy due for renewal from 28 November 2019 until 27 November 2020.

Contact the CGU Rural Centre on 1300 137 863 or your Account Partner if you want to discuss any of these options.

5. Broker learning and events

CGU Business as Unusual

As part of our Broker Support Package we launched our first ever online live event series, CGU Business as Unusual. The series features a variety of high-profile Australian speakers with the aim of inspiring and educating our Broker Partners.

The first event kicked off on Tuesday 19 May with prominent businessman Mark Bouris as our speaker. Mr Bouris conveyed the importance of communicating with their clients during this challenging period, as well as some of the basic things they can do to protect their business financially. If you missed out on attending the event, watch the recording.

The second event was held on Tuesday 9 June and featured digital futurist Chris Riddell. Mr Riddell explained how technology is rapidly changing both the way we do business and the types of experiences that customers will expect in the future. Brokers that dialled into the live event have been allocated 1 CPD point. Watch the recording (please note this recording will be available to watch until the 10 July).

Our next online event will be held on Thursday 9 July with former Prime Minister, the Honourable John Howard. You will have recently received an invitation to this very special event however if you missed out, please contact your Account Partner.

Watch the recording of Mark Bouris

Watch the recording of Chris Riddell (only available till 10 July)

NIBA Webinar Series

CGU also partnered with the National Insurance Brokers Association (NIBA) to provide ontinued Professional Development accredited learning and development opportunities for brokers. Topics have included Unoccupied Businesses: Do’s and Don’ts, The Trusted Risk Adviser and Tips for working from home.

6. Give your business a digital marketing boost on us

Many businesses across all industries have adopted digital marketing as part of their essential business development and growth strategy. The role of digital marketing goes beyond brand awareness – companies, businesses, and individuals have realised its importance and are using it as a tool to better connect with their customers, boost online reputation and presence, and stay ahead of the competition.

Whether you have a small, medium, or large business, digital marketing will play an important role in shaping the future of your business.

This is why we want our brokers to have access to digital marketing through our partnership with a digital agency called OneAffiniti. Through this, you’ll be able to tailor a monthly email and social campaign, a customised microsite and a dedicated OneAffiniti Broker Success Manager to help you engage with your clients and maximise renewal retention and business development. This program is fully funded by CGU.

7. Fast five with our State Broker Solutions Managers

Our Fast 5 for this edition is with our State Managers for Broker Solutions. We’ve tried to keep it brief, but being in the positions that they are, they all love a chat – which makes perfect sense! So, without further ado, allow us to introduce the team…

-

Peg Vaghaye - State Manager, Broker Solutions NSW & ACT

My team looks after 750 brokers in NSW and ACT. Prior to joining CGU, I was a broker and underwriter and experienced both roles in Auckland and Sydney where I specialised in Professional Risks, I’ve also been a National Relationship Manager for Steadfast prior to my current role.

How have you been maintaining Broker connectedness during C-19?

I’ve enjoyed being able to communicate with brokers in different ways like Webex and Facetime. Like most, I have days when I miss the social aspects of our role and I’ve found that whenever I needed a pick-me-up, brokers have only been so happy to receive a catch-up call. There are many coffee and cocktail appointments promised after all this is over!

What’s your biggest tip on how to look after yourself during these unprecedented times?

Routine – I relish my morning and afternoon walks and try my best to make time for it.

What learnings will you take with you (personal or professional) when we come out the other side of C-19?

I don’t live close to a café for that morning coffee fix so I picked up barista and cocktail making skills…espresso martini anyone?

-

Tiana Iuvale - State Manager, Broker Solutions QLD

I started my career in the Advertising industry before moving into Marketing, Operational, Sales/Business Development and B2B and B2C Leadership roles in Retail, Heavy Machinery parts and Premium Funding before landing (quite accidentally) in Insurance 8 years ago!

How have you been maintaining Broker connectedness during C-19?

My team and I moved quickly to execute virtual Underwriter and BAU visitations. We treated the lockdown period as an opportunity to lift our digital game and put the technology platforms already available to IAG employees to good use with our partners. Technology has been a fantastic enabler to remain connected and close with our broker partners, so we can continue to engage and support in our best capacity.

What’s your biggest tip on how to look after yourself during these unprecedented times?

Without a doubt it’s self-care through recognising the signs of fatigue and knowing when to step away from work. Moving to remote working on technology platforms has created longer hours in front of multiple screens, and it’s too easy to forget to take regular breaks to walk, stretch and practice some regular mindfulness.

What learnings will you take with you (personal or professional) when we come out the other side of C-19?

Personally – to practice what I preach! I always ensure my team are mentally and physically safe and well but am not so great at observing this myself.

Professionally – through adversity and disruption is change and growth. Always lean into uncertainty, and look for the learnings to build your skill set and capabilities to remain future ready in a changing world of work.

-

Jacinta Chisholm - State Manager, Broker Solutions VIC & TAS

I am the Broker Solutions Manager for Victoria and Tasmania at CGU. I lead a large team of people who are responsible for the overall relationship with a number of our key Partners. I am held responsible for the overall growth and profitability of our business in these states, play an active leadership role within the business and ensure our business strategies are communicated and acted upon. I act as a final escalation point at a state level for any matters concerning Underwriting and Claims.

How have you been maintaining Broker connectedness during C-19

With the assistance of our teams! We service over 600 offices including AR’s in VIC/TAS and so we very much share this priority between us. The first few weeks we had an influx of calls and queries with respect to our position on various matters. The priority was being responsive and available. We are now in a more proactive position and I set myself a challenge to catch up with a Broker a day on Webex the past few weeks and into June. So far so good and it goes to show that once you’ve utilised the technology a few times the confidence to do so is there.

What’s your biggest tip on how to look after yourself during these unprecedented times?

Get some Vitamin D and switch off! Be strict with the times you will work and the times you will “Leave the Office”. I shut our office door at home, leave for the day and do not log back in that evening. I can then give my full attention to family and me time. I also put a meeting in my calendar each day to go for a walk or workout and I keep this as a priority. Vitamin D is underrated! Making sure you stay connected to your support network is also vital. It’s too easy to stay isolated when working from home and a quick chat with a peer, colleague or friend can really help to reset and lift your mood.

What learnings will you take with you (personal or professional) when we come out the other side of C-19?

Our business and our people are strong and can adapt to a crisis seamlessly. Solid support, open communication and truly putting our people first in Week 1 set us up for success.

Stopping and reflecting makes for better business decisions – COVID-19 forced this and it should have always been a priority.

Travel less for work – this gains more time back in our personal and professional lives and our business results have continued to improve without it.

We will completely rethink the way we engage with Partners and our Teams – in some instances we have felt better connected than before – there is something in this.

Health and Wellbeing is not a throwaway line. You perform better in your role, you are switched on and alert and your personal life is more enjoyable. It must be a priority.

-

Meicha McCagh - State Manager, Broker Solutions WA

I am the State Broker Solutions Manager for Western Australia. I lead a team of 9 individuals who are responsible for our partner relationships across our state. I am held responsible for the overall growth and profitability of our business, play an active leadership role within the business and ensure our business strategies are communicated and acted upon

How have you been maintaining Broker connectedness during C-19?

Simple pulse check ins with brokers have been really positive. Discussing how they have managed their teams during C19, how they’re finding working from home, what their clients are telling them and sharing our client and broker support package details with them. Sharing resources and information with them. Essentially doing what we were doing pre C19 just in a virtual sense.

What’s your biggest tip on how to look after yourself during these unprecedented times?

My two recommendations are to stay connected to your teams. This can be done both formally or informally. We are extremely active via virtual methods whether it be video chat or otherwise and reminds us we remain part of a team, experiencing the same issues, concerns and challenges and are here to support one another.

Additionally, listen to your body and mind. If it’s time to take a step away from the desk, to get some fresh air, have a change of scenery, give yourself the flexibility to do that. Scheduling breaks, stretching your legs and giving yourself a break from screen time is a must!

What learnings will you take with you (personal or professional) when we come out the other side of C-19?

The changing way we work, the ways in which we can work and reflecting on the way we used to work has been extremely enlightening. I’ve also learnt that both CGU and myself on an individual level can be extremely agile, resilient and resourceful when needed. Our industry will absolutely function in a different way post C19.

-

Joseph Clifton - State Manager, Broker Solutions SA & NT

In my current role I manage the business distribution team who are the frontline of our business looking after broker partners, as well as taking a company leadership role within SA & the NT. All of my insurance career has been within IAG starting at SGIC before moving to CGU. I have been fortunate to have a number of different roles during my 18 years at CGU in both SA & VIC. What keeps me interested in the industry is the people we work with & the difference we make within the community. I obtained my Fellowship completing post graduate studies with Deakin University specialising in General Insurance.

How have you been maintaining Broker connectedness during C-19?

Video conferencing has been the main tool to remain connected, but making proactive phone calls to brokers without any specific agenda has been the most rewarding.

What’s your biggest tip on how to look after yourself during these unprecedented times?

Having a regular schedule with breaks included has been key for me. I am lucky to have a study at home which has been a dedicated workplace & I try not to use this room at other times. Ensuring that I spend most of the weekend outdoors & walking the dog has also been vital.

What learnings will you take with you (personal or professional) when we come out the other side of C-19?

I have really enjoyed spending more time at home with my family. We are often traveling & finding entertainment away from home, but after many of these options were removed I have appreciated more what I have at home. The isolation has also made me reflect on the close relationships I have with many friends & business partners which add so much satisfaction into my life. The disruption has also made me evaluate the way I have always done things & reminded me how good a restaurant cooked steak can be.