We're here for you

We're here for you

Whether you need make a claim or to ask a question we're only a phone call away.

For claims

Call13 24 8024 hours, 7 days a week

For general enquiries

Call13 24 81Personal Insurance

8:30am to 5:00pm AEDST, Monday to Friday

Business Insurance

8:00am to 8:00pm AEDST, Monday to Friday

While overseas

Call +61 3 9601 8222CGU InSTRIVE

Keep up to date with broker insights for the quarter

October 2020

Check out news and views in this quarter's CGU InSTRIVE

1. A message from Brad Robson

Welcome to the October edition of CGU EDGE.

As I write this message, our teams at CGU are entering 26 weeks of working from home and I am sure a number of our broking partners are in a similar position. While some states have been operating under lighter restrictions, our thoughts are with our colleagues and brokers in Victoria who are still experiencing tough times under lockdown. With myself based in Sydney, I have had the opportunity to see a number of brokers, many of which have expressed some of the challenges confronting us all.

We continue to be cognisant of the pressures faced by our customers during these times and have extended our Customer Support measures to 31 December 2020. To see these measures, go to our COVID-19 FAQ page for brokers.

I also received positive feedback from the many of you who have enjoyed our Business as Unusual series, I’m pleased to announce we will continue this series with our next live event being held very soon with another Australian icon. It was great to see so many of you tune in to our last event with former Prime Minister, The Honourable John Howard which you can watch here. It was an absolute honour for me interview him and hear his insights on the path he sees our nation following in order to get through this unprecedented time. Additionally, he conveyed the importance of staying connected with clients and ensuring that mental wellbeing is given priority.

We couldn’t agree more with him and that is why we will continue to provide our brokers with access to the OneAffiniti digital marketing platform to help you keep in touch with your customers. We are also supporting conversations around mental health and well-being with training programmes in partnership with Lifeline being held for our brokers around the country on how to manage being an ‘Accidental Counsellor’.

Finally, I’d like to end this note with an inspirational video from Collingwood Head Coach, Nathan Buckley, who shares his tips for staying mentally and physically resilient. Click here to watch.

Take care and keep well.

Brad Robson

2. Be Bushfire ready

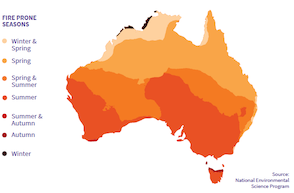

With current trends indicating that bushfire seasons are getting longer and more extreme, the number of catastrophic bushfire events will continue to increase. It is critical for communities to understand their level of risk and ensure they take the right steps to be prepared for future bushfire seasons. We are pleased to be able to share with you 2 downloadable factsheets that can help you and your customers to do just that.

The first fact sheet looks at Bushfire Risk and includes latest scientific observations and weather trends to help people understand how bushfire risk is changing across the country. The fact sheet also outlines the top five Local Government Areas across each state that are likely to experience higher bushfire risk.

The next fact sheet relates to Bushfire Awareness to help educate Australians about the causes of bushfires and how to ensure they are adequately insured. This Bushfire Awareness fact sheet also provides an explanation of Bushfire Attack Levels (BALs) and what these mean for rebuilding after a bushfire.

The trends were collated by IAG’s Natural Perils team, which comprises climate scientists, meteorologists, hydrologists and statisticians whose job is to understand the extreme weather events that impact customers so that they can accurately assess the risks customers face, while also looking at what we can do to help customers and communities mitigate those risks.

To help Australians prepare for emergencies IAG has also partnered with the Australian Red Cross to co-create the Get Prepared app, which helps people build an emergency plan.

Click on the following links to download these factsheets which you can distribute to your customers:

3. OneAffiniti

In June this year, CGU launched an exclusive Digital marketing support program for our Broker partners during the COVID-19 pandemic. Managed by global marketing specialist, OneAffiniti, this initiative is offered to help Brokers help their customers by delivering informative content that demonstrates your value as a trusted advisor and industry expert.

Since launching the program, OneAffiniti have reported a tremendous uptake with over 200 Brokers recognising the importance of utilising marketing support to engage with their customers and prospects consistently. Everyday more and more Brokers are taking advantage of this opportunity and as a result they are now engaging with over 250,000 customers and prospects, collecting valuable insights and generating new opportunities.

The response from customers has also been outstanding with engagement rates reported as double the industry average for the Insurance sector. OneAffiniti have also advised a substantial level of engagement with content linked to Product and Public Liability, Professional Indemnity and Unoccupied businesses with many customers requesting for Broker call backs and more information on the subject matters.

“This initiative has been great. The biggest challenge for in-house marketing teams such as ours is generating enough content that provides value for our clients.

I was pleasantly surprised with the engagement we received last month. The leads that resulted have been shared to our Brokers and the ability for me to manage these centrally from the Insights Hub has been useful. Our Brokers have appreciated the information provided to them via this exercise. It has allowed them to be better prepared when they next speak to their clients.”

Alliance Insurance Broking Services

If you haven’t already signed up for the OneAffiniti program, here’s some features and benefits to consider:

- Zero cost involved - exclusively sponsored by CGU for our Broker partners

- Professional marketing campaigns - designed and delivered for you

- Your branding - remain independent

- High quality informative content created by industry experts

- Measure success and leads - simplified reporting delivered directly to you

- Minimal time and effort required - manage your marketing in 5mins per month

If you’d like to take the first step to creating opportunities for your business without the headaches of sophisticated marketing, contact OneAffiniti.

4. Preventing workplace injury: Culture v Process

Our experience over many years confirms what we as liability underwriters already know - there is an inherent exposure to significant workplace injuries in the blue-collar manual labour sector.

This has always existed for liability insurers and traditionally, underwriters focused on ‘induction procedures’ and ‘toolbox meetings’ to validate a business risk management - but injuries are still happening. Often, investigations into these accidents show that risk controls have failed in some way or have been inadequate, non-existent or there was a disregard for procedure and training.

As a result, underwriting assessments are evolving to look beyond documents and paper when we try to assess workplace injury risk management and instead, consider how risk awareness and safety are embedded within an organisation’s culture as more meaningful measure of risk maturity. In a strong safety culture, everyone feels responsible for safety and pursues it daily and unsafe conditions and behaviours are reported, corrected and treated as early warning signs rather than false alarms or near-misses.

Number of workplace injuries in Australia in 2020

|

Industry of workplace |

Preliminary worker deaths year-to-date, 10 September 2019 |

Preliminary worker deaths year-to-date, 10 September 2020 |

|

Transport, postal & warehousing |

46 |

36 |

|

Agriculture, forestry & fishing |

22 |

22 |

|

Construction |

15 |

18 |

|

Public administration & safety |

8 |

12 |

|

Manufacturing |

8 |

9 |

|

Mining |

8 |

5 |

Source: Safe Work Australia's annual Work-related Traumatic Injury Fatalities report

Every organisation irrespective of size operates with some form of culture. Organisational culture is not new, often it is implied rather than expressly defined. How it impacts business success is a relatively new consideration for business operators.

Risk and risk management must be understood by all staff in an organisation for it to be successful. We have an opportunity to collectively work together to change the landscape and start the conversation about culture and safety; to promote higher regard for positive safety culture in underwriting.

Our Liability team understand workplace injury and many of the risks that we have a long history of writing. When you access our Liability Team, you not only access stable and reliable capacity, you also access the wealth of experience and knowledge that comes from our whole organisation.

Our people are our difference. We have broad capability and experience across our national liability team, strong relationships, bespoke solutions and flexibility to drive our business. We offer:

- Diverse market engagement – SME’s through to Complex Risks

- Umbrella and excess capability

- E&O and Recall Expense limits available

- Our capacity is $50,000,000 for any one risk

- Partner in multinational network providing overseas paper

- Relationship driven underwriting team

Did you know?

20% of accidents are from environmental causes – dangerous machinery and equipment, dangerous substances, natural phenomenon, physical hazards (sitting, standing, reaching, lifting).

80% of accidents are caused by human error – lack of knowledge, lack of skill, physical limitations (strength, fatigue, medications, affected by substance) and poor safety attitude (undisciplined, disobedient, overconfident, impatient, careless or emotional).

5. Important notices

Business Packages

From 14 November 2020, we will be asking for additional information on roof, wall and floor construction types on Sunrise. Where asbestos is declared, there will be no change to renewal rating or underwriting for the first year. New business will refer for asbestos construction and be underwritten accordingly (asbestos construction will auto-decline if located in a cyclone zone). This separation of asbestos will help us more appropriately underwrite construction types such as tile and iron roofs which has historically been rated within a general category that includes asbestos. Please contact your SME underwriter or Account Partner for any queries.

Commercial Motor

From 14 November 2020, we will be adding an ANZIC code selection for Commercial Motor and New Business and Renewals. The ANZIC code selection will not impact upon renewal pricing or acceptance. This information will help us access meaningful data and improve our rating especially for well performing ANZIC Occupations. Please contact your SME underwriter or Account Partner for any queries.

Updating references to the Biosecurity Act 2015

In case you missed the notice we send out regarding the SPDS that will be issued on certain Business Pack, Office Pack and Motor Trades policies please click here.

6. Fast five with Kate Lowery, Specialist Underwriter - Complex Liability

-

What are your highs and lows of working from home?

For me there aren't a lot of lows, the commute to and from the office was free time to myself which I am missing, however I'm loving no ironing.

-

What is your latest Netflix binge?

War of the Worlds mini-series and Away (mission to Mars Hillary Swank and that guy from the Good Wife...).

-

Where is the first place you would go as soon as you are able to?

Hawaii.

-

Have you learnt anything new in the past few months?

I learnt that I really don't like painting and resilience is my superpower!

-

What do you think is the biggest challenge in the liability space today?

Maintaining balance – whether it be coverage, price, costs, turnaround time, creating bespoke solutions, standard products, managing data, collecting the data and information we need to effectively underwrite, implementing change, meeting portfolio objectives while also meeting the needs of our customers and partners, inflation, superimposed bodily inflation, legislation, regulation, legal environment, addressing emerging risks or remedying areas of poor performance.

There are many levers that we can pull to make the necessary adjustments. Pull too much, pull none, or pull too little each level has an effect. Finding the right mix and balance is key.